Updated: Nov 10, 2023

The Chartered Accountancy (CA) exam, managed by The Institute of Chartered Accountants of India (ICAI), is without a doubt one of the most difficult exam in the country. A dependable calculator is your trusted buddy when it comes to areas like taxation, accounting, and financial management. You'll need a calculator that's both inexpensive and dependable, and it doesn't have to be particularly complicated for this reason. In this blog post, we'll look at the finest calculators for CA exam preparation that strike the appropriate balance of price, quality, and features, allowing you to make an informed decision.

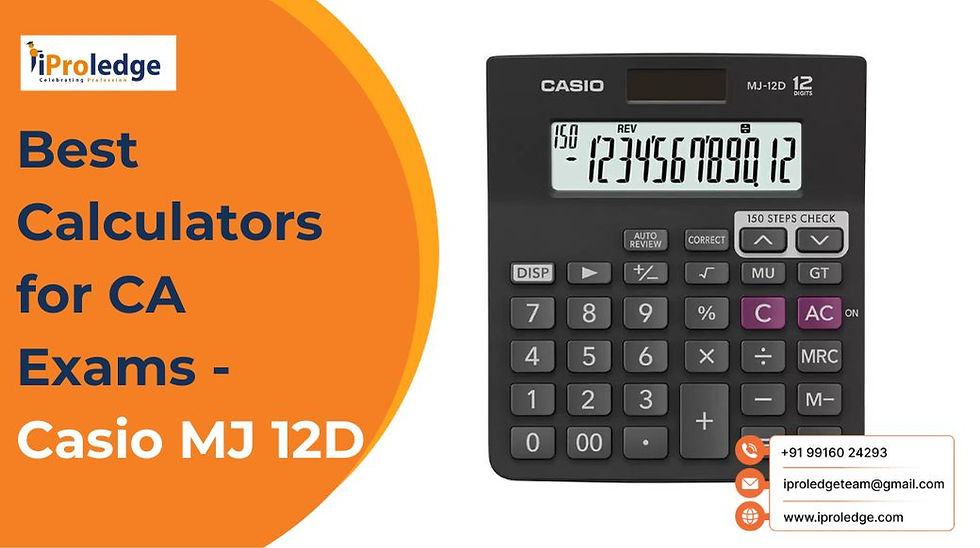

1. Casio MJ 12D

The Casio MJ 12D is a basic calculator that does the job without breaking the bank. It has a sturdy structure, making it an excellent companion for your CA exam studies. While it lacks advanced capabilities, it is noted for its simplicity, which can be advantageous during the exam. The Casio MJ 12D has an easy-to-read LED light display and a well-organized keyboard for a smooth calculation experience.

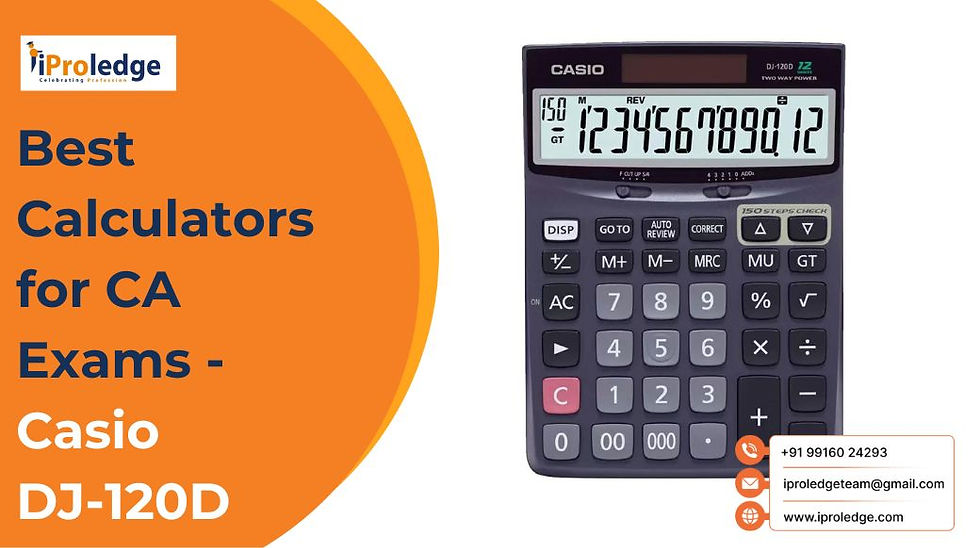

2. Casio DJ-120D

Casio DJ-120D is yet another dependable alternative from the well-known Casio brand. This calculator strikes a good combination between quality and price, making it a popular choice among CA Exams hopefuls. It has important features and a dual-screen for better functionality. The keyboard is well-designed, allowing for speedy and accurate calculations, which is critical for your CA exams.

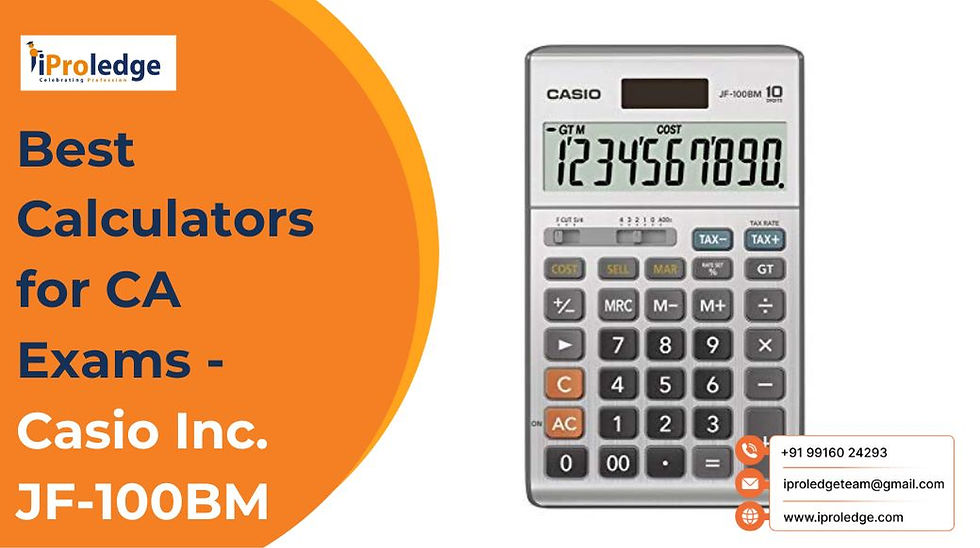

3. Casio Inc. JF-100BM

The Casio Inc. JF-100BM is well-known for its affordability and durability. It is a practical alternative for students preparing for the CA exam, as it has all of the necessary features for accounting and finance computations. This calculator's ordered keyboard layout and high quality construction ensure that you may rely on it throughout your exam preparations.

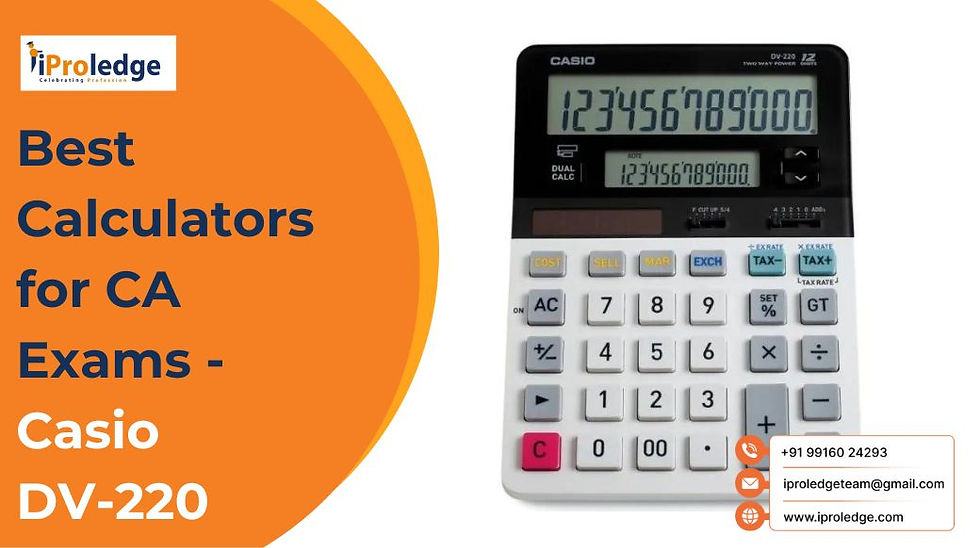

4. Casio DV-220

The Casio DV-220 calculator combines price and dependability. It boasts a clear LED display and an easy-to-use keyboard layout that makes it ideal for accounting and financial operations. Its dual-screen capability is a plus, since it allows you to maintain track of your work while solving challenges. The Casio DV-220 is built to last, so it will serve you well during your CA exam trip.

5. Comix Desktop Calculator

For CA exams candidates, the Comix Desktop Calculator is a versatile solution. It's well-known for its high-quality construction and crucial features, such as an ordered keyboard and a dual-screen. The LED display is clear and easy to read, which is critical for doing quick and accurate computations. This calculator has an amazing price-performance ratio.

Finally, when studying for the CA exam, a dependable and cost-effective calculator is needed. The Casio MJ 12D, Casio DJ-120D, Casio Inc. JF-100BM, Casio DV-220, and the Comix Desktop Calculator are all fantastic calculators to consider. They provide the appropriate blend of price, quality, and vital features, ensuring that you can confidently tackle the complicated mathematics in your CA Exams.

To make an informed decision, check the latest reviews and authenticity of these calculators on websites such as Amazon. A long-lasting and dependable calculator might be your dependable friend on your path to become a Chartered Accountant in India. Best wishes for your CA exam preparations!

FAQs

1. Why is a calculator important for CA exam preparation?

During the CA exam, a calculator is necessary for conducting advanced calculations in areas such as taxation, accounting, and financial management. It facilitates quick and accurate computations, making it an indispensable tool for candidates.

2. What features should one look for in a calculator for CA exam preparation?

A good CA exam calculator should balance price, dependability, and functionality. A crisp LED display, a well-organized keyboard layout, durability, and specific functionality pertinent to accounting and finance computations are all important qualities.

3. Why are the mentioned Casio models recommended for CA exam preparation?

The Casio MJ 12D, Casio DJ-120D, Casio Inc. JF-100BM, and Casio DV-220 are suggested for their affordable, dependable, and necessary characteristics. They are built to last and have clear displays and well-designed keyboards, making them ideal for the demanding demands of CA test studies.

4. What is the significance of a dual-screen feature in calculators for CA exams?

Candidates can keep track of their work while solving problems using the dual-screen capability seen in calculators such as the Casio DJ-120D and Casio DV-220. This tool improves functionality and speed during exam preparation, especially in cases involving many calculations.

5. How can candidates ensure the authenticity of a calculator before purchasing it for CA exam preparation?

Candidates should read the most recent reviews and ratings on reputable outlets such as Amazon before purchasing a calculator. They can also confirm the legitimacy of the merchandise by confirming it is from a reputed brand such as Casio. This aids in making an informed decision and selecting a calculator that suits the unique requirements of CA exam study.

6. Which calculator is good for CA students?

Casio MJ 12d calculator best for CA students.